MyFICO's top plan is even more expensive than LifeLock's and costs twice as much as IdentityForce's top plan on a yearly basis. MyFICO does watch for activity in court records, bank accounts, credit cards and the "dark web," but you'll get no alerts of data breaches or property-title changes, no monitoring of address changes, medical records or investment accounts, and no security software. It's the opposite of LifeLock in that respect. In terms of identity theft protection, however, MyFICO Premier offers only the basics. If monitoring your credit is your primary interest, look no further. Even better, it's the only service that provides the FICO scores used by most lenders to assess credit-worthiness.

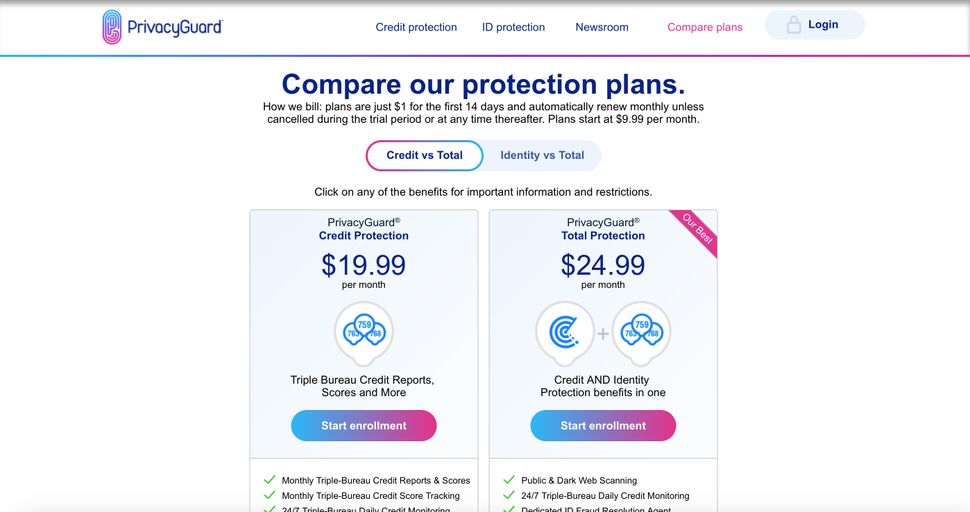

PRIVACY GUARD PROTECTION FULL

It offers full credit reports and credit scores from all three major credit bureaus every month. MyFICO Premier is simply the best credit-monitoring service we've used. Setting up and cancelling LifeLock was easy. In our three months of using LifeLock, we got nine alerts notifying us of credit inquiries and possible credit-card overspending. The downside is that even the most expensive LifeLock plan doesn't provide a credit-score simulator. LifeLock will help cover your losses if your identity is stolen on its watch, and its insurance coverage goes up to $3 million while rival services cap out at $1 million.

PRIVACY GUARD PROTECTION PASSWORD

It lets you initiate a TransUnion credit lock straight from the user interface and includes Norton 360, one of the best antivirus programs around that also comes with a password manager and VPN. LifeLock Ultimate Plus offers a new Equifax credit score and credit report every day, and scores and reports from the other two bureaus every month. Its top-tier service, LifeLock Ultimate Plus, monitors the most kinds of personal data, including investment and retirement accounts, payday lenders, credit cards and people-search websites. It even lets you know if someone's trying to steal your phone number.

LifeLock is one of the priciest identity-theft-protection services we've reviewed. Account setup and subscription cancellation were both easy and painless. IdentityForce also told us when were were approaching our spending limits. In our day-to-day use of IdentityForce UltraSecure+Credit, we got a fair number of alerts. Few other identity theft protection services offer this basic security feature.

PRIVACY GUARD PROTECTION ANDROID

It also includes an excellent credit-score simulator, anti-keylogging software for Windows, security features (including unlimited VPN service) for its Android and iOS apps and best of all, two-factor authentication to protect your account. IdentityForce even scans court records and cybercrime forums for mentions of your name and Social Security number, alerts you when registered sex offenders move into the neighborhood and has a one-click button to initiate credit freezes. Credit scores and reports from all three credit bureaus are refreshed quarterly most types of financial accounts are monitored, including investment accounts and the $1 million identity-restoration insurance covers travel expenses and childcare as well as lost funds and lost wages.

0 kommentar(er)

0 kommentar(er)